Strategic Limited Partners Health Insurance provides precise, comprehensive coverage for your healthcare needs. With customizable plans and extensive network options, they ensure that you receive the best possible care.

As a trusted provider, Strategic Limited Partners prioritizes your well-being, offering peace of mind and financial security.

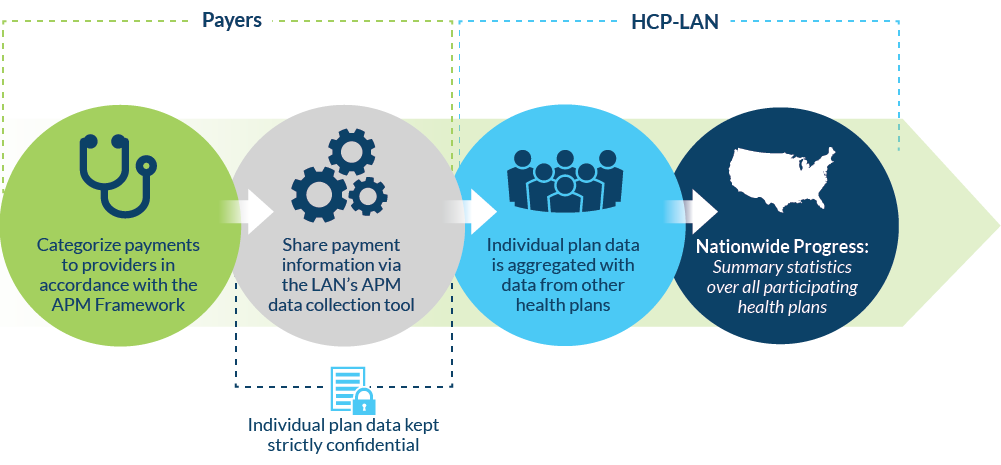

Credit: hcp-lan.org

Understanding Health Insurance Options

Health insurance is a crucial consideration for individuals and businesses alike. By understanding the different health insurance options available, you can make well-informed decisions that suit your needs best.

Types Of Health Insurance Plans

Health insurance plans come in various forms, each offering different coverage levels. Common types include:

- Health Maintenance Organizations (HMOs)

- Preferred Provider Organizations (PPOs)

- Exclusive Provider Organizations (EPOs)

- Point of Service (POS) Plans

Importance Of Strategic Limited Partners Health Insurance

Strategic Limited Partners Health Insurance stands out for its comprehensive coverage and tailored solutions. Key benefits of choosing this insurance include:

- Customized Plans to Fit Your Needs

- Access to a Wide Network of Healthcare Providers

- Cost-Efficient Options for Quality Care

- Enhanced Wellness and Preventive Services

Credit: www.bcg.com

Choosing The Right Coverage

Finding the right health insurance coverage from Strategic Limited Partners involves a careful evaluation of your needs and preferences. With a range of options available, it’s important to choose wisely to ensure optimal coverage for your healthcare needs.

HTML response:

Choosing the Right Coverage

When it comes to health insurance, choosing the right coverage is crucial for you and your family. Assessing your healthcare needs and evaluating different plan options are two important steps in making an informed decision. This section will guide you through these steps and provide you with the necessary information to select the best health insurance plan for your specific needs.

Assessing Your Healthcare Needs

Assessing your healthcare needs is the first step in finding the right health insurance coverage. Start by considering any ongoing medical conditions, prescription medications, and anticipated healthcare services for the coming year. Are you planning to start a family, or do you have dependents with specific medical requirements? By understanding your healthcare needs, you can make an informed decision on the level of coverage required.

Evaluating Different Plan Options

After assessing your healthcare needs, it’s time to evaluate different plan options. Consider factors such as premiums, deductibles, and out-of-pocket costs to determine the affordability of each plan. Review the network of healthcare providers and ensure that your preferred doctors and hospitals are included. Take note of the coverage for specialist visits, emergency care, and prescription drugs. By comparing the features and benefits of different plans, you can find the one that offers the best fit for your healthcare needs.

| Plan Features | Plan A | Plan B | Plan C |

|---|---|---|---|

| Monthly Premiums | $100 | $150 | $200 |

| Deductible | $1,000 | $750 | $500 |

| Out-of-Pocket Maximum | $5,000 | $3,500 | $2,000 |

To help you make a more informed decision, consider the table above that compares the key features of different plan options. As you can see, Plan C has higher monthly premiums but lower deductibles and out-of-pocket maximums. However, it’s important to evaluate your healthcare needs and financial situation to determine which plan suits you best.

With a clear understanding of your healthcare needs and a thorough evaluation of different plan options, you’re now equipped to choose the right health insurance coverage. Don’t rush this decision, take the time to analyze all factors and make a choice that provides adequate coverage at an affordable cost. Remember, the goal is to ensure that you have the necessary protection and peace of mind when it comes to your health.

Maximizing Coverage Benefits

Maximizing coverage benefits is crucial when it comes to strategic limited partners health insurance. With a focus on comprehensive coverage and tailored plans, individuals can ensure maximum benefits for their specific healthcare needs.

Utilizing Preventive Services

One of the most effective ways to maximize your health insurance coverage benefits is by utilizing preventive services. These services focus on identifying potential health issues before they become more serious, ultimately saving you both time and money.

Regular check-ups, vaccinations, and screenings play a crucial role in maintaining your overall well-being. By taking advantage of these preventive measures, you can detect any health concerns early on, allowing for prompt and less invasive treatment options.

Insurance plans often cover preventive services at no additional cost to you, meaning you can receive important medical attention without straining your budget. These services encompass a wide range of areas, from routine physical exams to cancer screenings.

Remember, prevention is key to staying healthy. By making use of the preventive services included in your health insurance coverage, you can take charge of your well-being and stay on top of your health.

Understanding Out-of-network Coverage

When it comes to health insurance coverage, it’s essential to understand the details of your plan – particularly regarding out-of-network coverage. While your plan may provide financial protection for visiting in-network healthcare providers, what happens if you need medical care outside of your network?

Out-of-network refers to healthcare providers and facilities that are not contracted with your insurance company. While some health insurance plans provide coverage for out-of-network services, it’s important to review the terms and conditions carefully to avoid any surprises.

If you find yourself in a situation where you require out-of-network care, having a comprehensive understanding of your coverage can save you from unexpected expenses. In such instances, having an insurance plan that offers a percentage of coverage can help alleviate the financial burden.

Remember to check with your health insurance provider about the specifics of your out-of-network coverage. Being aware of these details will ensure you can make informed decisions regarding your healthcare and make the most out of your coverage benefits.

Navigating The Claims Process

Submitting claims effectively and understanding reimbursement procedures are crucial aspects of managing your Strategic Limited Partners health insurance.

Submitting Claims Effectively

Follow these steps to submit your claims:

- Gather all necessary documents

- Fill out claim forms accurately

- Submit claims online or through mail

Understanding Reimbursement Procedures

Key points to grasp about reimbursement procedures:

- Know your coverage and benefits

- Understand co-pay and deductible requirements

- Keep track of claim status for updates

Managing Health Insurance Costs

When it comes to managing health insurance costs, Strategic Limited Partners Health Insurance offers effective strategies to optimize premiums and deductibles and make the most of Health Savings Accounts (HSAs).

Optimizing Premiums And Deductibles

Strategic Limited Partners works with you to find the right balance between premiums and deductibles, ensuring that you have adequate coverage without overpaying. By analyzing your specific needs and risk tolerance, they can tailor a plan that optimizes premiums and deductibles based on your unique circumstances.

Utilizing Health Savings Accounts (hsa)

Health Savings Accounts (HSAs) are a valuable tool for managing healthcare costs, and Strategic Limited Partners can help you make the most of this benefit. By contributing pre-tax money to an HSA, you can save on healthcare expenses and build a financial safety net for future medical needs.

Planning For Change And Updates

As life brings changes, it’s essential to adapt your health insurance coverage to meet your evolving needs. Staying aware of policy updates and effectively managing life events can ensure that your health insurance remains comprehensive and tailored to your specific requirements.

Adapting To Life Events

Life events such as marriage, childbirth, or career changes can significantly impact your health insurance needs. Evaluating and adjusting your coverage in response to these pivotal moments can provide the necessary protection for you and your loved ones. Understanding the options available and making informed decisions can help you maintain optimal health insurance coverage for every stage of life.

Staying Informed About Policy Changes

Regularly staying informed about policy changes is crucial to identifying potential impacts on your health insurance. Keeping abreast of updates and amendments to your plan can help you anticipate any alterations in costs or coverage. This proactive approach allows you to make adjustments promptly and ensure that your health insurance aligns with current regulations and industry standards.

Seeking Additional Support And Resources

When it comes to Strategic Limited Partners Health Insurance, individuals may find themselves in need of additional support and resources to optimize their healthcare experience.

Utilizing Employer Resources

Take advantage of employer-provided wellness programs for valuable support towards a healthier lifestyle.

Accessing Community Health Programs

Explore community health initiatives that offer various resources to improve well-being and access specialized care.

Credit: www.scphealth.com

Conclusion

In examining the benefits of Strategic Limited Partners health insurance, it’s clear: tailored coverage matters. Finding a plan that aligns with your unique needs and budget can be a game-changer. With the right coverage in place, you can focus on what’s truly important – your health and peace of mind.