Civil car coverage insurance has received positive reviews for its comprehensive protection and affordable prices. Customers appreciate the wide range of coverage options and the ease of filing claims.

When searching for car insurance, it’s essential to consider the feedback from other policyholders. Understanding how a particular insurance provider has been rated can help in making informed decisions. Civil car coverage insurance has garnered favorable reviews for its responsive customer service and hassle-free claims process.

With a focus on providing comprehensive protection at a reasonable cost, this insurance option stands out. Reviewers also praise the flexibility and customization offered, providing peace of mind for drivers. Whether it’s the straightforward policy terms or the reliable support when needed, Civil car coverage insurance seems to deliver a positive experience for its customers.

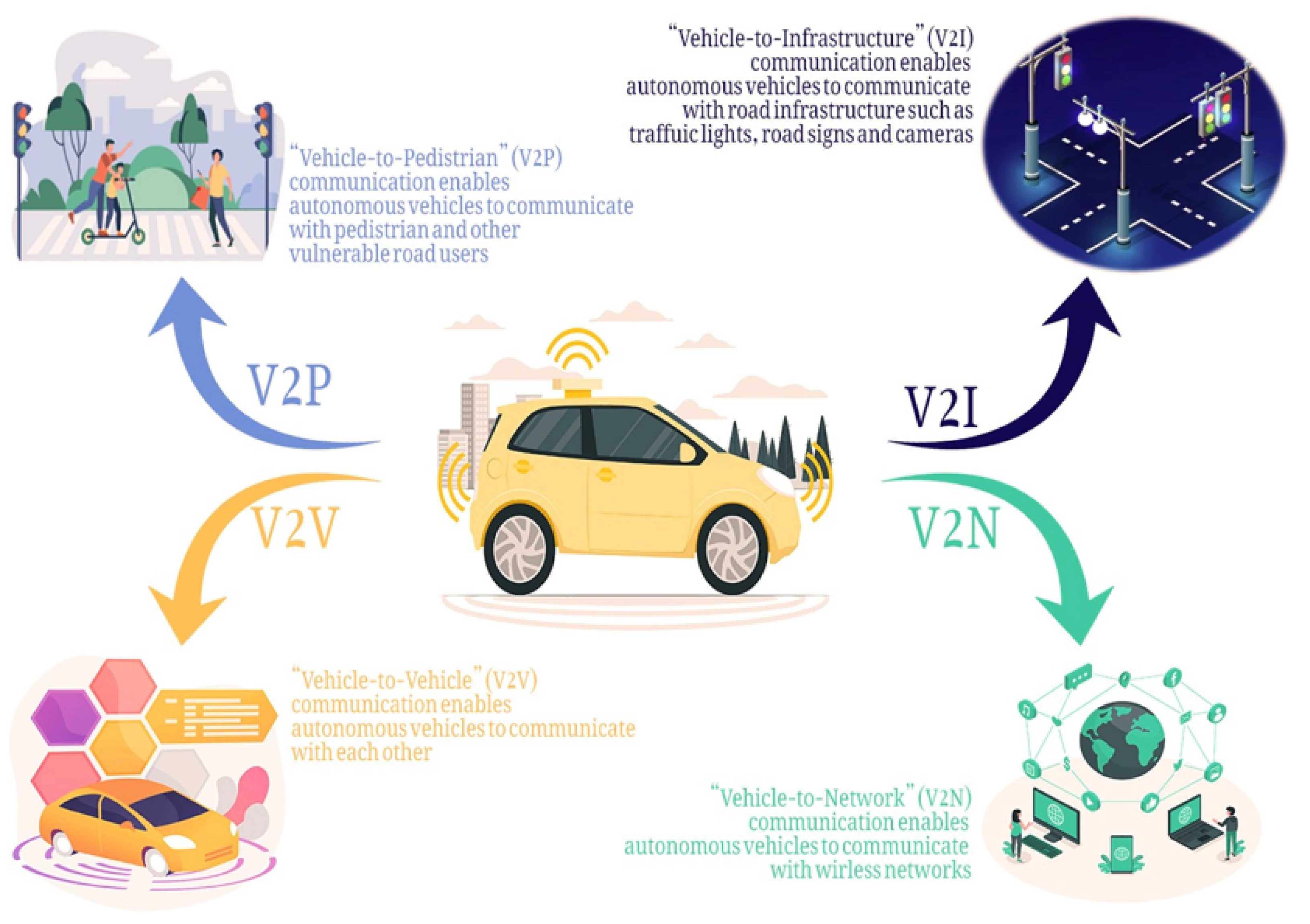

Credit: www.mdpi.com

Understanding Civil Car Coverage Insurance

Civil car coverage insurance is a crucial aspect of protecting yourself from potential financial liabilities arising from any civil damages or injuries caused by your vehicle. It provides coverage for third-party bodily injury and property damage, giving you peace of mind on the road.

What Is Civil Car Coverage Insurance?

Civil car coverage insurance is a type of insurance that protects you if you are held responsible for causing damage or injury to another person or their property with your vehicle. It typically includes coverage for third-party bodily injuries and property damage, providing financial protection for the insured party.

Importance Of Civil Car Coverage Insurance

- Covers third-party bodily injury and property damage

- Protects you from potential financial liabilities

- Provides peace of mind on the road

Having civil car coverage insurance is essential for safeguarding yourself against unexpected accidents or incidents that may result in legal actions or financial obligations. It ensures that you are not left financially vulnerable in the event of a claim against you.

Credit: www.tdi.texas.gov

Factors To Consider When Choosing A Civil Car Coverage Insurance Policy

When selecting a civil car coverage insurance policy, there are several essential factors to take into account in order to ensure you are adequately protected. From coverage options to the claims process and customer service, each aspect plays a critical role in determining the effectiveness of your insurance policy. Let’s explore the key factors to consider when evaluating civil car coverage insurance reviews.

Coverage Options

It’s crucial to assess the coverage options offered by the civil car insurance policy. Look for comprehensive coverage that includes protection against various types of accidents, damage, and liability, ensuring you get the best value for your premium.

Cost And Affordability

Consider the cost and affordability of the policy. While it’s important to find a policy that fits within your budget, it’s equally vital to ensure it provides adequate coverage without compromising on quality. Compare premiums and deductibles to find a balance between cost and protection.

Claims Process

Review the claims process, as it’s crucial for a smooth experience in the event of an accident or damage. Understand the process of filing a claim, the timelines for approval, and the overall efficiency of the insurance company in handling claims.

Customer Service

Assess the quality of the insurance company’s customer service. Responsive and helpful customer support is essential for resolving queries, addressing concerns, and providing assistance when needed. Look for positive reviews and ratings related to customer service.

Policy Exclusions

Be aware of the exclusions within the policy. Understand what is not covered to avoid unpleasant surprises in the future. Review the fine print and clarify any ambiguities or concerns regarding policy exclusions before finalizing your decision.

Top-rated Civil Car Coverage Insurance Policies

When it comes to choosing the right civil car coverage insurance, it’s essential to review and compare policies to find the best fit for your needs. Here, we examine the top-rated civil car coverage insurance policies that offer comprehensive protection and excellent customer service.

Policy A

Coverage: Policy A provides a wide range of coverage for civil car incidents, including property damage, bodily injury liability, uninsured motorist coverage, and comprehensive coverage.

Benefits:

- Competitive rates for drivers with a clean record

- 24/7 customer support for claims and inquiries

Policy B

Coverage: Policy B offers extensive protection for civil car accidents, ensuring that you are financially safeguarded in various scenarios, such as collisions, theft, and natural disasters.

Advantages:

- Flexible payment options to suit your budget

- Rental car reimbursement for added convenience post-accident

Policy C

Coverage: Policy C prioritizes comprehensive coverage, ensuring that you are protected in the event of civil car-related incidents, from minor fender benders to major collisions.

Key Features:

- Towing and labor coverage for roadside assistance

- Personal injury protection for medical expenses and lost wages

Comparison Of Civil Car Coverage Insurance Deals

Deal 1: Comprehensive coverage with roadside assistance.

Deal 2: Basic coverage with lower premium rate.

Deal 2: Lower premium rate with limited coverage options.

Deal 3: Enhanced coverage with rental car benefits.

Deal 1: Comprehensive coverage with extended benefits.

Deal 3: Enhanced coverage with additional perks.

Customer Reviews And Feedback

Customer reviews and feedback play a crucial role in determining the quality and reliability of a service. When it comes to civil car coverage insurance, reading through customer reviews can provide valuable insights. In this section, we will explore both positive and negative reviews to help you make an informed decision.

Positive Reviews

Positive reviews act as a testimonial to the exceptional quality of a civil car coverage insurance plan. Here are some reasons why customers were satisfied with their experience:

- Easy Claims Process: Customers appreciated the hassle-free and straightforward claims process. This greatly reduced stress and ensured quick resolutions.

- Excellent Customer Service: Many customers have praised the prompt and knowledgeable customer service representatives who went out of their way to address their concerns.

- Comprehensive Coverage: A common positive aspect mentioned by customers is the extensive coverage of the civil car insurance plans. They felt more secure knowing that their policy covered a wide range of scenarios.

- Competitive Premiums: Customers were pleasantly surprised by the affordability of the coverage provided. They found the premiums to be reasonable without compromising on the level of protection.

Negative Reviews

While most customers had positive experiences, it’s important to consider negative reviews as well. Here are some concerns raised by customers:

- Lengthy Claim Processing: Some customers faced delays or lengthy processes when filing for claims. This led to frustration and inconvenience during an already stressful time.

- Difficulty in Communication: A few customers mentioned difficulties in reaching customer service representatives and receiving timely responses to their queries or concerns.

- Policy Limitations: Some customers expressed dissatisfaction with certain limitations in their policy coverage. These limitations, often discovered after an incident, led to disappointment and feelings of inadequate protection.

- Premium Increases: A handful of customers noticed significant premium increases at renewal. While inflation and other factors can contribute to changes in premiums, these unexpected increases caught some customers off guard.

Remember, customer reviews and feedback are subjective and may vary from person to person. Take note of both positive and negative reviews while considering your own individual needs and circumstances.

Credit: www.amazon.com

Conclusion

Civil Car Coverage Insurance stands out for providing comprehensive protection and efficient customer service. With positive reviews highlighting its affordability and reliability, choosing Civil Car Coverage may offer peace of mind on the road. Make an informed decision by considering the experiences shared in these reviews.