Village Medical Insurance provides comprehensive coverage and financial protection for individuals living in rural areas. With a wide range of health insurance plans, Village Medical Insurance ensures that individuals in rural communities have access to affordable healthcare services and assistance when they need it the most.

Challenges In Rural Healthcare

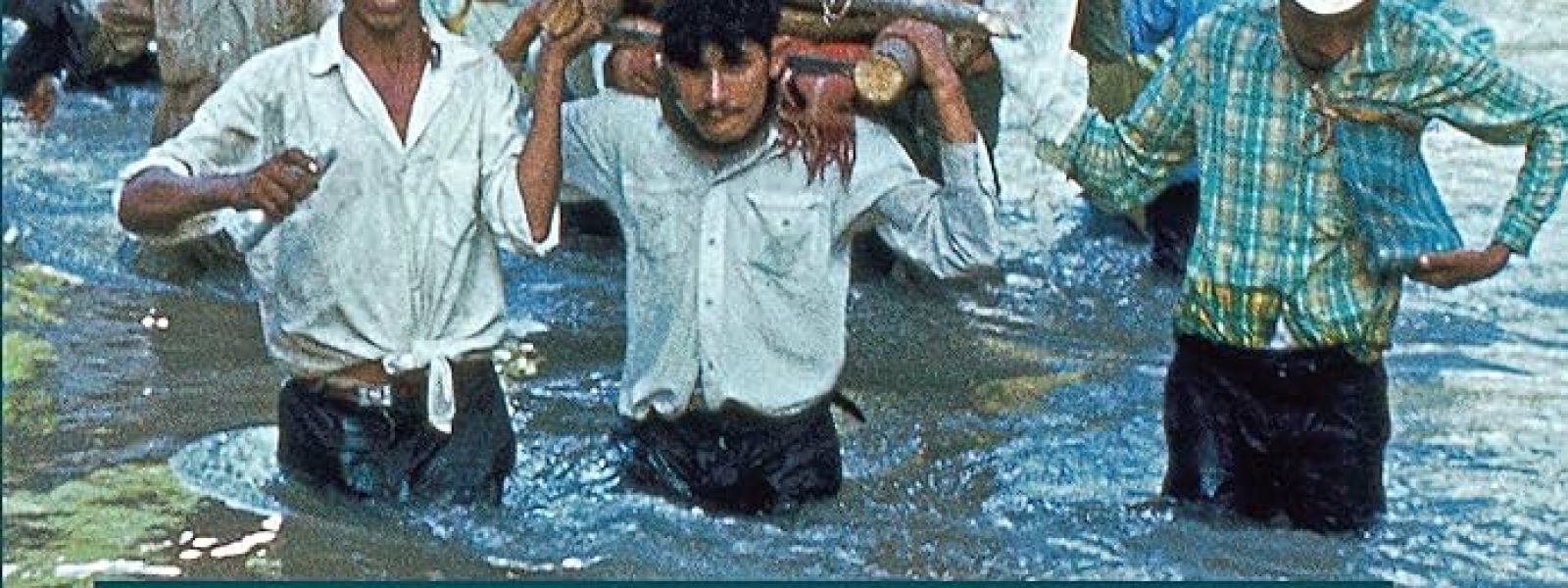

In rural areas, the accessibility and affordability of proper healthcare have been persistent challenges for many communities. Limited access to medical facilities and lack of financial resources are two key factors that contribute to these challenges.

Limited Access To Medical Facilities

In rural areas, accessing medical facilities can be a significant challenge for the local population. The distance between villages and the nearest hospitals or clinics can be vast, resulting in limited availability of healthcare services. This geographical barrier often leads to delayed or inadequate medical assistance, especially in emergency situations.

Moreover, the limited number of healthcare professionals practicing in rural areas exacerbates the problem. Doctors and specialists often prefer urban settings due to better career opportunities and access to advanced medical facilities. As a result, rural communities experience a shortage of healthcare providers, making it even more challenging for villagers to access timely and quality medical care.

Lack Of Financial Resources

Another significant challenge in rural healthcare revolves around the lack of financial resources. Villagers often face financial constraints, hindering their ability to afford necessary healthcare services and treatments. This limited financial capacity restricts their options for medical care and forces them to compromise on their health.

The absence of comprehensive medical insurance coverage also contributes to the overall healthcare challenges in rural areas. Without insurance, villagers have to bear the full burden of medical expenses, making even basic healthcare services unaffordable for many. This financial burden not only affects individuals but also impacts the overall healthcare infrastructure in rural communities.

The dearth of medical facilities combined with the financial constraints faced by rural villagers underscores the urgent need to address the healthcare challenges in these regions. Initiatives such as village medical insurance can play a crucial role in bridging the gap and ensuring that essential healthcare services are accessible and affordable for all.

Credit: ballardbrief.byu.edu

Benefits Of Village Medical Insurance

When it comes to healthcare in rural areas, village medical insurance proves to be a game-changer. The benefits of village medical insurance are numerous and have the potential to transform the lives of individuals and communities. Not only does it provide affordable healthcare options, but it also ensures access to a wider range of medical services.

Affordable Healthcare Options

Village medical insurance offers a range of affordable healthcare options that cater to the unique needs of rural communities. These insurance plans are designed to be flexible, providing various coverage levels to suit individuals and families. By opting for village medical insurance, individuals can access necessary medical care without worrying about the financial burden that usually accompanies it.

Access To A Wider Range Of Medical Services

One of the most significant benefits of village medical insurance is the access it provides to a wider range of medical services. In rural areas, healthcare options can be limited, with only a few clinics or hospitals available. However, village medical insurance opens up avenues for individuals to seek medical treatments in nearby towns or cities. This ensures that individuals can avail the specialized care they may require, without any geographical constraints.

Moreover, village medical insurance also covers various medical procedures and services that may not be available locally. These include diagnostic tests, surgeries, consultations with specialists, and even emergency medical services. The availability of these services can significantly enhance the quality of healthcare in rural areas, ensuring that individuals receive the care they deserve.

Overall, village medical insurance offers affordable healthcare options and access to a wider range of medical services, bridging the healthcare gap in rural areas. By providing these essential benefits, village medical insurance is instrumental in safeguarding the health and well-being of individuals and communities, ultimately contributing to the overall development of rural societies.

Successful Village Medical Insurance Programs

In many developing countries, access to quality healthcare is a major challenge, especially for rural communities. Village medical insurance programs have emerged as a successful solution to address this issue. These programs aim to provide affordable and comprehensive healthcare coverage to individuals living in remote villages. In this article, we will explore two case studies that highlight the success and impact of village medical insurance programs in different countries.

Case Study 1: Program In [country]

In [Country], a village medical insurance program has been implemented to improve access to healthcare in rural areas. This program works on a community-based model, where individuals in the village pool their resources to create a common insurance fund. The fund is then managed by a local committee and used to cover various medical expenses.

This program has been highly successful in [Country]. It has significantly increased the number of villagers with access to healthcare services, improving health outcomes and reducing financial burdens. The program not only covers hospitalization and treatment expenses but also provides preventive care and basic health services.

Through this program, villagers have access to a network of healthcare providers, ensuring they receive timely and quality medical care. The coverage includes consultations, medications, diagnostic tests, and even specialist referrals if needed. Villagers contribute a nominal premium, making the program affordable and accessible to all members of the community.

Case Study 2: Program In [country]

Another successful village medical insurance program can be found in [Country]. This program focuses on ensuring healthcare coverage for vulnerable populations living in remote areas. It is designed to address the specific healthcare needs of these communities, which are often neglected by traditional insurance schemes.

The [Country] program provides a range of benefits, including primary healthcare services, emergency care, maternity care, and even coverage for chronic diseases. The program has been instrumental in reducing healthcare disparities and improving health outcomes in rural areas.

A key feature of this program is its emphasis on preventive care and health education. Villagers receive regular health check-ups, vaccinations, and screenings to detect and prevent diseases at an early stage. This proactive approach has proven effective in reducing the prevalence of preventable illnesses.

The [Country] program also takes into account the unique challenges faced by rural communities, such as limited transportation options. It ensures that healthcare services are easily accessible by setting up mobile clinics and strengthening existing healthcare facilities in remote areas.

Government Initiatives

The government plays a crucial role in promoting and expanding village medical insurance programs. These initiatives are designed to provide affordable and accessible healthcare coverage to residents in rural areas. Through various policies and recommendations, the government aims to improve the coverage and ensure that individuals living in villages have access to the medical services they need.

Role Of Government In Promoting Village Medical Insurance

The government actively promotes village medical insurance programs as a means of bridging the healthcare gap between rural and urban areas. Here are some key initiatives undertaken by the government:

- Financial support: The government provides financial support to village medical insurance schemes to make them affordable and sustainable. This ensures that residents in villages have access to quality healthcare without facing significant financial burden.

- Awareness campaigns: The government conducts awareness campaigns to educate villagers about the benefits of medical insurance. These campaigns aim to increase knowledge and understanding of insurance policies, encouraging more individuals to enroll in village medical insurance programs.

- Infrastructure development: The government invests in the development of healthcare infrastructure in rural areas. This includes setting up healthcare centers, hospitals, and clinics, equipped with necessary medical facilities. Improved infrastructure promotes the availability and accessibility of healthcare services, making village medical insurance more valuable to the residents.

- Partnerships with insurance providers: The government collaborates with insurance providers to expand the coverage and reach of village medical insurance programs. These partnerships ensure that insurance companies offer customized policies catering to the specific healthcare needs of rural communities.

- Incentives for insurance providers: The government provides incentives to insurance providers who actively participate in village medical insurance programs. This encourages more providers to offer coverage in rural areas, increasing competition and driving the overall quality of healthcare services.

- Policy framework and regulations: The government sets up a robust policy framework and regulations to govern village medical insurance programs. This ensures that insurance providers comply with the required standards and deliver adequate coverage to the insured individuals.

Policy Recommendations For Improved Coverage

In order to enhance coverage and effectiveness of village medical insurance, certain policy recommendations can be considered:

- Expanding insurance network: The government should focus on expanding the network of insurance providers in rural areas. This would increase competition and provide more choices to individuals, ultimately leading to improved coverage and better services.

- Customized insurance policies: Insurance providers should develop policies that are specifically tailored to suit the healthcare needs and requirements of individuals residing in villages. Customized policies can ensure comprehensive coverage and affordability.

- Streamlined claim procedures: Simplifying and expediting the claim procedures can encourage more rural individuals to enroll in village medical insurance. Removing unnecessary paperwork and reducing the time taken for claim processing would enhance user experience and boost confidence in the insurance program.

- Regular health screenings and check-ups: It is important for village medical insurance programs to incorporate regular health screenings and check-ups. This preventive approach can help identify health risks at an early stage, leading to timely interventions and reducing healthcare costs in the long run.

- Public-private partnerships: Collaborations between the government, insurance providers, and non-governmental organizations can improve the efficiency and coverage of village medical insurance programs. Public-private partnerships can leverage resources, expertise, and networks to address the healthcare needs of rural communities effectively.

Challenges In Implementing Village Medical Insurance

Implementing village medical insurance in rural areas brings with it a set of unique challenges that need to be addressed for the program to be successful. From lack of awareness and education to inadequate infrastructure and technology, these hurdles must be overcome to provide accessible and effective healthcare coverage to the residents of villages.

Awareness And Education

The first major challenge is the lack of awareness and education among village communities regarding medical insurance. Many individuals in rural areas are unaware of the benefits and importance of having insurance coverage for their healthcare needs. Without proper awareness, they may not understand how to enroll, where to seek medical attention, or how to utilize their insurance effectively.

Solution:

- Organize community outreach programs to educate villagers about the concept of medical insurance and its advantages.

- Collaborate with local influencers and community leaders to spread awareness and emphasize the importance of healthcare coverage.

- Create educational materials, such as brochures and posters, in local languages to ensure effective communication and understanding.

- Engage in one-on-one counseling sessions to address any misconceptions or doubts villagers may have.

Infrastructure And Technology

The lack of proper infrastructure and technology is another significant hurdle in implementing village medical insurance. Rural areas often face challenges such as limited healthcare facilities, poor road connectivity, and inadequate communication networks, making it difficult for insurance providers to reach out to the target population effectively.

Solution:

- Invest in developing healthcare infrastructure in villages, including setting up medical clinics and hospitals.

- Improve road connectivity and transportation facilities to ensure easy access to healthcare facilities.

- Establish telemedicine services to bridge the gap between villagers and healthcare professionals, enabling remote consultations and diagnosis.

- Utilize mobile-based applications and SMS services to reach and educate villagers about their insurance coverage and healthcare options.

By addressing the challenges of awareness and education and improving infrastructure and technology, the implementation of village medical insurance can become more effective and accessible to the residents of rural areas. It is crucial to prioritize these aspects to ensure that healthcare coverage reaches those who need it the most.

Credit: www.amazon.com

Partnerships For Sustainable Village Medical Insurance

Village medical insurance plays a crucial role in providing affordable healthcare services to rural communities. However, its long-term viability and effectiveness depend on strong partnerships between governments, NGOs, and the private sector. Collaboration between these entities helps ensure that village medical insurance programs are sustainable and able to continue providing essential healthcare coverage to those in need. In this article, we will explore the importance of partnerships and financial support in ensuring the long-term viability of village medical insurance.

Collaboration Between Governments, Ngos, And The Private Sector

Effective collaboration between governments, non-governmental organizations (NGOs), and the private sector is essential for the success of village medical insurance programs. Each stakeholder brings unique expertise, resources, and networks to the table, enabling comprehensive coverage and equitable access to healthcare services in rural areas.

Here is how each entity contributes to the sustainability of village medical insurance:

- Governments: Governments play a pivotal role in establishing policies, regulations, and legislation that support the implementation and expansion of village medical insurance. They provide the legal framework necessary to ensure quality healthcare services and coordinate with NGOs and the private sector to bridge the gaps between rural communities and healthcare providers.

- NGOs: Non-governmental organizations are at the forefront of healthcare delivery in rural communities. By partnering with governments and the private sector, NGOs work towards improving healthcare infrastructure, training healthcare professionals, and creating awareness about the benefits of village medical insurance. Their grassroots presence and knowledge of local contexts make them vital contributors to sustainable healthcare coverage.

- Private Sector: The private sector, including insurance companies, hospitals, and pharmaceutical companies, brings invaluable resources and expertise to village medical insurance programs. Through partnerships, the private sector can contribute financially, provide technical support, and share best practices to optimize the efficiency and affordability of healthcare services. Their involvement helps bridge the resource gap in underserved areas and improves access to quality healthcare.

Financial Support For Long-term Viability

Financial support is crucial for the long-term viability of village medical insurance. Sustainable funding allows these programs to operate effectively, provide comprehensive coverage, and adapt to changing healthcare needs. Here are some key aspects of financial support:

- Government Funding: Governments need to allocate adequate resources to support village medical insurance programs. The allocation of funds specifically for healthcare services in rural areas ensures that these programs can effectively cover the costs of medical treatments, diagnostics, and preventive care.

- NGO and Private Sector Grants: NGOs and the private sector can provide grants and donations to support the implementation and expansion of village medical insurance programs. These grants can be utilized to develop healthcare infrastructure, train healthcare professionals, and cover administrative costs, ultimately improving the accessibility and quality of healthcare services.

- Community Contributions: Involving the community in the financial aspect of village medical insurance programs fosters ownership and sustainability. Implementing a user-friendly premium payment system allows community members to contribute to their own healthcare coverage. Additionally, community-based fundraising initiatives can help raise funds to further support these programs.

- Public-Private Partnerships: Collaborations between the public and private sectors not only facilitate improved delivery of healthcare services but also provide financial support. Public-private partnerships can leverage the resources and funding capacities of the private sector while benefiting from the government’s regulatory framework and accessibility goals.

By ensuring strong partnerships and adequate financial support, village medical insurance programs can achieve long-term sustainability, empower rural communities, and ensure access to essential healthcare services for all.

Credit: www.eastasiaforum.org

Frequently Asked Questions For Village Medical Insurance

When Was Village Medical Founded?

Village Medical was founded in [insert year].

Who Bought Associates In Family Medicine?

Associates in Family Medicine was acquired by [Name of the Buyer].

What Is Village Medical Insurance?

Village medical insurance is a healthcare policy designed to provide affordable and accessible coverage to individuals living in rural areas.

Why Should I Consider Village Medical Insurance?

Village medical insurance offers tailored coverage that addresses the specific healthcare needs of rural residents, ensuring they have access to quality healthcare services when they need them.

Conclusion

Village Medical Insurance offers comprehensive coverage options for individuals and families in rural communities. With its affordable premiums and extensive network of healthcare providers, it ensures access to quality medical care when needed. By providing financial protection against unexpected medical expenses, Village Medical Insurance helps residents of rural areas to overcome the financial barriers to healthcare.

It is the perfect solution for those looking to secure their health and well-being in rural settings.